I’m seeing more and more industry groups that have either broken out above August highs or on the verge of doing so. Meanwhile, I believe it’s important to focus on individual stocks within these improving groups for possible trading candidates. I prefer sticking with leading stocks in leading industry groups. Accordingly, check out the home improvements area ($DJUSHI), along with one leading stock in the space:

There are a number of technical positives on this chart, but I want to see the DJUSHI clear overhead price resistance just beneath 720 AND see LOW make its key breakout above 215. That combination would suggest higher prices and further relative outperformance ahead.

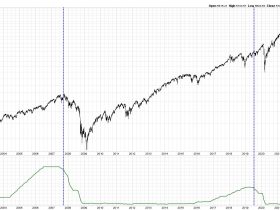

The next question might be, “well, what about Home Depot (HD)?” I use current relative strength to decide the likely relative performance in the weeks and months ahead. Wall Street has clearly decided that LOW is the better place to be – ever since the pandemic hit:

This LOW:HD relative chart shows that LOW bottomed relative to HD in March 2020. They’ve significantly outperformed ever since. Personally, I’d stick with LOW over HD – until this relative chart proves otherwise. The green arrow is my relative “line in the sand”. A break beneath this would suggest that I at least consider replacing LOW with HD. Until then, stick with the leader.

LOW was added to our Income Portfolio a week ago as it’s not only a leading stock in a leading industry group, but it also has a nice 1.96% dividend yield to add to any further capital appreciation. On Monday, I’ll feature another of my favorite stocks that I added to our portfolio lineup last week. I see significant potential ahead for this one. Simply CLICK HERE and join our growing FREE EB Digest newsletter and we’ll get that chart out to you on Monday.

Happy trading!

Tom